MisterGopher

Active member

- Joined

- Nov 12, 2008

- Messages

- 418

- Reaction score

- 233

- Points

- 43

https://www.nytimes.com/athletic/65...ge-football-program-valuations-rankings-2025/

How much would it take to buy your favorite college football program?

As much as college football has drifted toward professionalization, one major difference remains: NCAA teams are not for sale. Not yet, at least. But private equity explorations by schools like Florida State and Boise State led The Athletic to consider a future where the Seminoles and Broncos could be bought and sold, just like the Boston Celtics or Tampa Bay Rays.

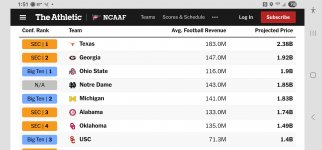

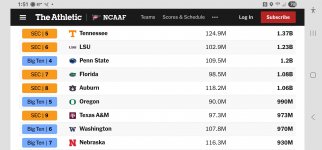

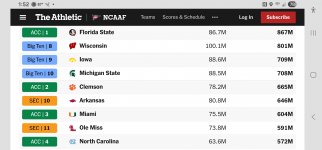

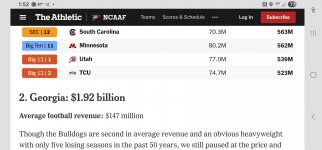

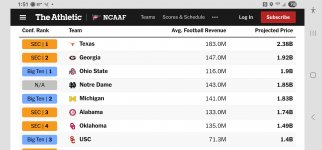

We approached the hypothetical question with a methodology that was part art, part science. We used real-life pro transactions to gauge purchase prices relative to a team’s revenue over the past three available years of data. NFL and NBA sales guided our ratios in the SEC and Big Ten, while the MLB and NHL were our rough benchmarks in the ACC and Big 12. For each school in a Power 4 conference (plus Notre Dame), we factored in everything from prestige and championships to facility renovations, population trends and realignment scenarios. That means treating Notre Dame more like the Los Angeles Lakers and Boston College more like the Kansas City Royals.

Because athletic departments isolate and report football revenue differently, our numbers are squishy. Actual transactions are much more complicated than what we did with a spreadsheet or what you see on “Shark Tank.” But the process is imperfect in the real world, too. What a team sells for (our objective with this story) is not the same as a team’s actual value (a story for another day). Buyers routinely pay a premium because there are only so many opportunities to own a sports team.

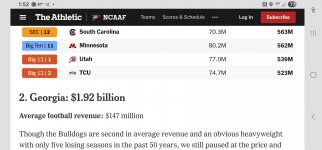

That sentiment would be even stronger in college football, where pre-established allegiances and irrational decisions already run deeper. Though Texas A&M just missed our $1 billion club, it’s easy to envision a few Aggies boosters artificially boosting the price to brag about spending 10 figures on their team. Or some Michigan fan paying extra to make sure the Wolverines out-priced Ohio State.

Do not take our numbers to the bank, literally or metaphorically. Instead, consider this a fun attempt at blending back-of-the-envelope math with common sense to price college programs like their professional peers — an exercise that’s theoretical for now … but might not be much longer.

How much would it take to buy your favorite college football program?

As much as college football has drifted toward professionalization, one major difference remains: NCAA teams are not for sale. Not yet, at least. But private equity explorations by schools like Florida State and Boise State led The Athletic to consider a future where the Seminoles and Broncos could be bought and sold, just like the Boston Celtics or Tampa Bay Rays.

We approached the hypothetical question with a methodology that was part art, part science. We used real-life pro transactions to gauge purchase prices relative to a team’s revenue over the past three available years of data. NFL and NBA sales guided our ratios in the SEC and Big Ten, while the MLB and NHL were our rough benchmarks in the ACC and Big 12. For each school in a Power 4 conference (plus Notre Dame), we factored in everything from prestige and championships to facility renovations, population trends and realignment scenarios. That means treating Notre Dame more like the Los Angeles Lakers and Boston College more like the Kansas City Royals.

Because athletic departments isolate and report football revenue differently, our numbers are squishy. Actual transactions are much more complicated than what we did with a spreadsheet or what you see on “Shark Tank.” But the process is imperfect in the real world, too. What a team sells for (our objective with this story) is not the same as a team’s actual value (a story for another day). Buyers routinely pay a premium because there are only so many opportunities to own a sports team.

That sentiment would be even stronger in college football, where pre-established allegiances and irrational decisions already run deeper. Though Texas A&M just missed our $1 billion club, it’s easy to envision a few Aggies boosters artificially boosting the price to brag about spending 10 figures on their team. Or some Michigan fan paying extra to make sure the Wolverines out-priced Ohio State.

Do not take our numbers to the bank, literally or metaphorically. Instead, consider this a fun attempt at blending back-of-the-envelope math with common sense to price college programs like their professional peers — an exercise that’s theoretical for now … but might not be much longer.

Last edited: